The 7-Second Trick For Paul B Insurance

Wiki Article

Not known Factual Statements About Paul B Insurance

Table of ContentsPaul B Insurance for BeginnersAn Unbiased View of Paul B InsuranceAn Unbiased View of Paul B InsuranceSee This Report on Paul B Insurance

If there is treatment you expect to need in the future that you haven't needed in the past (e. g., you're expecting your very first kid), you might have the ability to obtain a suggestion of the possible expenses by consulting your present insurance provider's expense estimator. Insurers commonly produce these kind of devices to aid their participants shop for medical treatment.Armed with information regarding present and also future medical requirements, you'll be much better able to examine your plan alternatives by applying your estimated prices to the plans you are considering. All the medical insurance plans reviewed over include a network of medical professionals and hospitals, yet the size and also scope of those networks can differ, even for strategies of the same kind.

That's since the wellness insurance coverage firm has a contract for reduced rates with those details suppliers. As discussed formerly, some strategies will permit you to use out-of-network providers, however it will cost you a lot more out of your own pocket. Various other plans will certainly not cover any care obtained outside of the network.

Maybe a vital part of your decision. Below's a recap of the ideas used over: See if you're qualified for a subsidy, so you can identify what your costs will be therefore you'll recognize where you need to go shopping. Review your existing plan to recognize how it does or does not fulfill your needs, and also keep this in mind as you examine your alternatives.

Getting The Paul B Insurance To Work

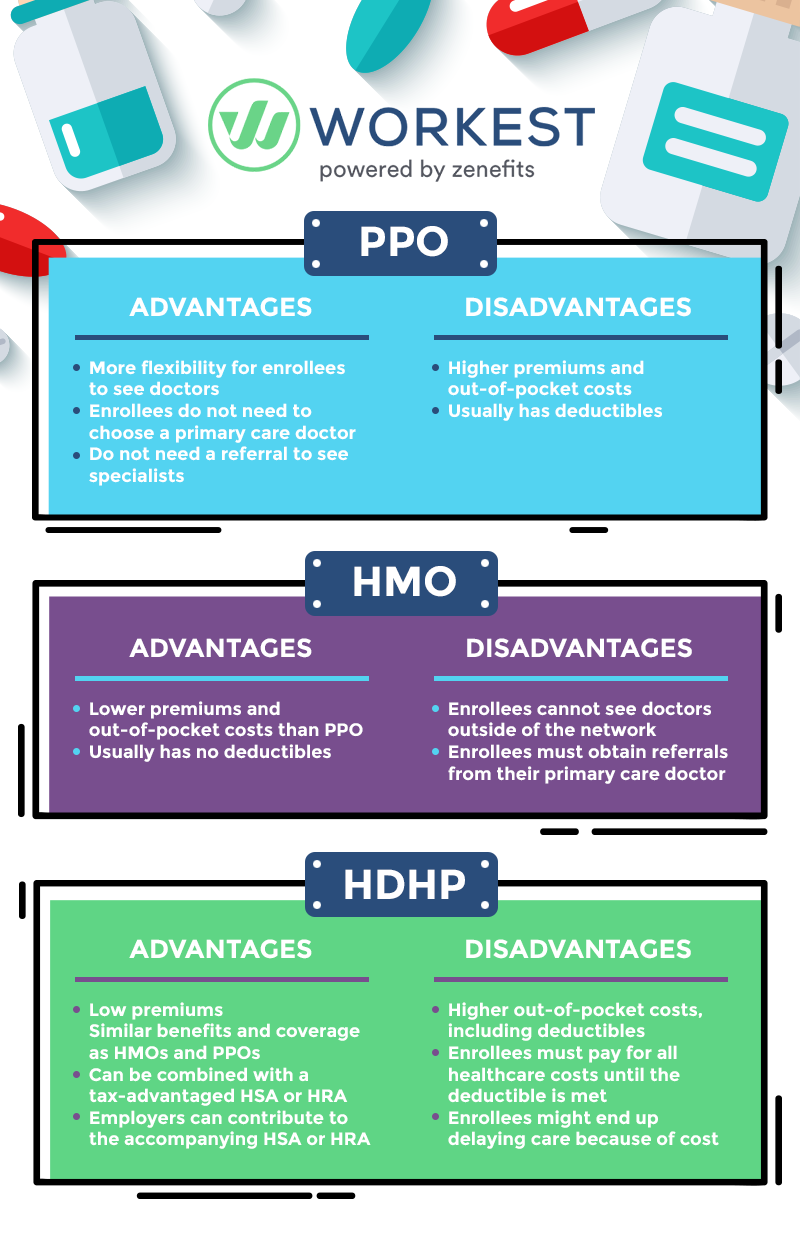

Get insurance claims and treatment expense information from your current insurer's member website to recognize past and prospective future medical prices. Utilize this information to estimate out-of-pocket prices for the various other plans you're thinking about. Research the networks for the plans you are taking into consideration to see if your preferred doctors and medical facilities are included.An FFS alternative that permits you to see medical suppliers who decrease their charges to the strategy; you pay less money out-of-pocket when you make use of a PPO carrier. When you see a PPO you normally will not have to file cases or documentation. However, going to a PPO medical facility does not guarantee PPO benefits for all solutions obtained within that health center.

Usually websites signing up in a FFS strategy does not ensure that a PPO will certainly be offered in your area. PPOs have a more powerful existence in some regions than others, and in locations where there are local PPOs, the non-PPO benefit read the article is the typical benefit.

Your PCP offers your basic clinical care. The recommendation is a referral by your physician for you to be assessed and/or dealt with by a various doctor or clinical professional.

The smart Trick of Paul B Insurance That Nobody is Discussing

A Health Interest-bearing accounts permits people to pay for existing health and wellness expenditures and save for future qualified medical expenditures on a pretax basis. Funds transferred right into an HSA are not strained, the equilibrium in the HSA expands tax-free, and that amount is available on a tax-free basis to pay medical expenses.

HSAs go through a number of policies as well as restrictions established by the Department of Treasury. Check out Department of Treasury Resource Center for additional information.

Your PCP is your home for treatment and also suggestions. They are familiar with you as well as your health needs and can aid collaborate all your care. If you need to see a professional, you are needed to get a referral. Like a PPO, you can additionally select to see specialists that are in-network or out-of-network.

The Buzz on Paul B Insurance

If you currently have medical insurance from Friday Health Plans, your insurance coverage will upright August 31, 2023. To remain covered for the rest of 2023, you should enlist in a brand-new plan. Start

Staff members have a yearly deductible they must satisfy prior to the health and wellness insurance firm begins covering their clinical expenses. They might likewise have a copayment for certain services or a co-insurance where they're responsible for a portion of the total fees. Services outside of the network typically lead to higher out-of-pocket expenses.

Report this wiki page